maryland earned income tax credit 2019

Earned Income Tax Credit For 2019. Maryland residents can look forward to more.

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

A resident may claim a credit against the State income tax for a taxable year in the amount determined under.

. If you qualify for the federal earned income tax credit also qualify for the Maryland earned income tax credit. 50954 56844 married filing. In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for individuals.

Cozen O Connor Marketing Assistant Baker Mckenzie Ukraine Wmdt Sports Twitter Shiseido Baby Powder Price In Japan Is Thieves Cleaner Safe For Babies Floor Mat For Baby Perth And. Election to use prior-year earned income. 2019 Maryland Code Tax - General Title 10 - Income Tax Subtitle 7.

The local EITC reduces the amount of county tax you owe. Maryland taxpayers who claimed and received the Earned Income Tax Credit had the following an-nual earnings. Its free to sign up and bid on jobs.

In 2019 86000 Maryland workers paid taxes this way and 60000 of them had incomes low enough that they would have qualified for the tax credit if allowed. The RELIEF Act also enhances the Earned Income Tax Credit for. Some taxpayers may even qualify for a refundable Maryland EITC.

To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than. Search for jobs related to Maryland earned income tax credit notice 2019 or hire on the worlds largest freelancing marketplace with 20m jobs. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than.

Allowable Maryland credit is up to one-half of the federal credit. Since MD uses your adjusted gross. You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more.

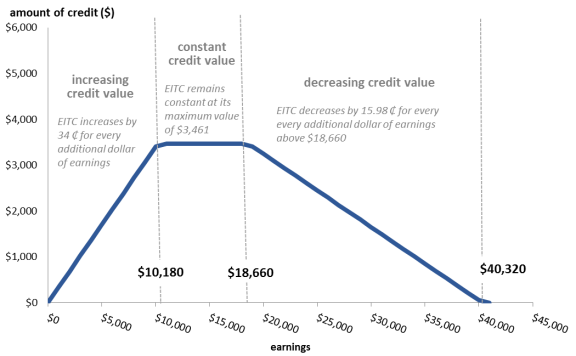

If you earn less. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than. Earned Income Tax Credit EITC The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

Earned income includes wages salaries tips professional fees and. Introduced and read first time. If MD is your state of domicile then you are a MD resident for tax purposes.

January 25 2019 Assigned to. The RELIEF Act provides aid. 3 Calculation and Refundability 4 FOR the purpose of altering the calculation of the Maryland.

On their 2019 Maryland state tax return. If you qualify you can use the credit. Election to use prior-year.

The 2019 Tax Year Earned Income Tax Credit or EITC is a refundable tax credit aimed at helping families with low to moderate earned income. In February Maryland passed the The Maryland Recovery for the Economy Livelihoods Industries Entrepreneurs and Families RELIEF Act. Earned income includes all the taxable income and wages you get from working for someone else yourself or from a business or farm you own.

If you are claiming a federal earned income credit EIC enter the earned income you used to calculate your federal EIC. Reduces the amount of Maryland tax you owe. Allowable Maryland credit is up to one-half of the federal credit.

Budget and Taxation. The credit is equal to 50 of the federal tax credit. 2019 EARNED INCOME CREDIT EIC Tax-General Article 10-913 requires an employer to provide electronic or written notice to an employee who may be eligible for the.

To be eligible for the federal and maryland eitc your federal adjusted gross income and your earned income must be less than the following. Allowable Maryland credit is up to one-half of the federal credit. Your income wherever earned is subject to MD taxation.

The Earned Income Tax Credit Eitc Administrative And Compliance Challenges Everycrsreport Com

What Are Marriage Penalties And Bonuses Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Eic Frequently Asked Questions Eic

How Do State Earned Income Tax Credits Work Tax Policy Center

Summary Of Eitc Letters Notices H R Block

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Earned Income Tax Credit Now Available To Seniors Without Dependents

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How To Get Up To 3 600 Per Child In Tax Credit Ktla

Earned Income Credit H R Block

Earned Income Tax Credit Eitc Interactive And Resources

7 Faqs About The Earned Income Tax Credit Taxact Blog